Published by Scotiabank on January 18, 2023

Rebekah Young- A DOUBLING OF SOCIAL HOUSING STOCK COULD HELP THOSE IN GREATEST NEED

- Home prices are cooling in an elevated interest rate environment in Canada, but housing affordability remains elusive. Imbalances persist across the housing continuum as a result of pervasive policy coordination failures.

- Fixing the broader housing supply issue remains an imperative and is still the first-best option. Signs that we are on this path are not promising. The recent uptick in housing starts is welcome but insufficient to restore affordability.

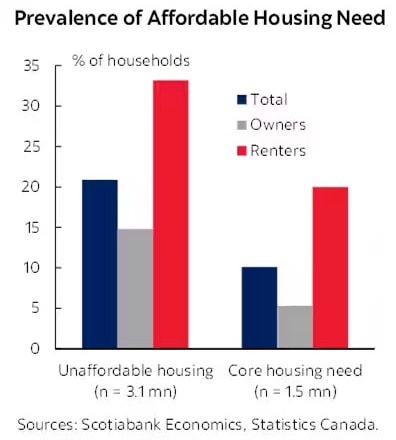

- For most Canadians, rising shelter costs will come at a hefty opportunity cost. For low income Canadians, it represents an impossible dilemma. Market-priced housing will likely never be affordable for a serious share of households—and easily those in the lowest income quintile—based on current trajectories (chart 1).

- Over 10% of Canadian households (or 1.5 mn) were in ‘core housing need’ according to the 2021 census. By definition, they have nowhere else to go in the marketplace. Another near-quarter of a million Canadians are homeless.

- The infrastructure to support these most vulnerable Canadians is stark: Canada’s stock of social housing represents just 3.5% (655 k) of its total housing stock, while wait-lists are years long. The moral case to urgently build out Canada’s anemic stock of social housing has never been stronger.

- The economic case is equally compelling. Governments are attempting to alleviate the strain on lower income households with a host of transfers, but the cost to do so will continue to escalate as shelter costs rise, market income provides little offset, and policy failures persist.

- A modest start would be doubling Canada’s stock of social housing to bring it in line with peers in the context of a coherent and well-resourced strategy (chart 2). This would not plug the gap, but it would be a start.

- Such an approach may be more responsive to the needs of Canada’s most vulnerable households and more cost-efficient for governments in the long run.

*Image is owned by Scotiabank